Investing Scientifically and Safely

By Experts, For You.

We build and manage buy-and-hold diversified

equity

portfolios for your long-term investment needs

We build and manage buy-and-hold diversified

equity

portfolios for your long-term investment needs

We build strategies scientifically using advanced ML algorithms.

The most suitable strategies out of the thousands created are selected for you.

Our investment experts train the ML algorithms and validate every strategy.

Invests in high-quality companies that compound capital at a rate higher than Nifty50 by ~8-10%. Your wealth grows because the investee companies grow their profits at high rates sustainably.

Invests in high-quality companies that compound capital at a rate higher than Nifty50 by ~8-10%. Your wealth grows because the investee companies grow their profits at high rates sustainably.

Similar return and risk profile as FidelFolio Great Himalayan Compounder, but with smaller minimum investment amount.

Key Figures

Backtested Strategies

Tools and Algorithms

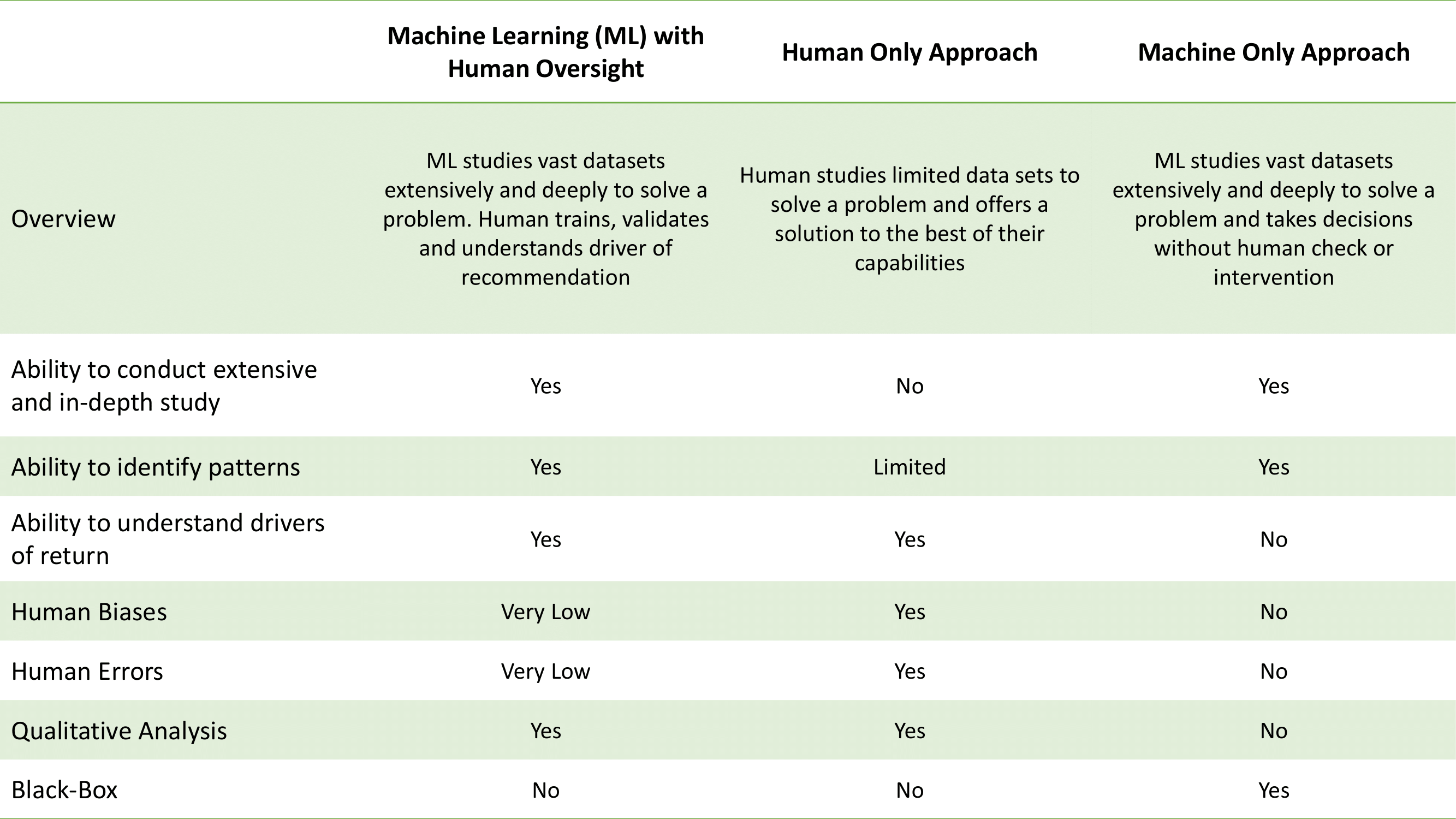

We believe that the holy grail of investment in today's world is where classic fundamental investment philosophy meets new age machines. Using our experience and deep understanding of investments, we have created proprietary machine learning algorithm to identify companies that would be profit compounders over the next 5-10 years. Our system has been trained with over 50 million data points of all listed companies in the Indian markets since 1991. Our system has been trained to identify stocks that are expected to generate 25%+ CAGR investment returns over long-term. These stocks are subjected to our proprietary clean accounting framework to weed out the companies with unscrupulous promoter and management.

We believe a combination of human and machines is the most effective duo in investments today. Our team of fundamental analysts works on understanding the underlying drivers and reasons why the stocks would produce compounding earnings over the next decade. Only once we achieve the conviction for each stock we include it in the portfolio. We believe human oversight is of utmost importance to effectively leverage the power of machines today.

FidelFolio Investments is an Equity Advisory Firm that invests in equity strategies devised by the powerful combination of machine learning and human oversight. We create long-term fundamental investment strategies scientifically, using proprietary Machine Learning (ML) algorithm.

Our investment team. Our buy-&-hold investment strategies are aimed at keeping low churn, avoiding stock market noise and focussing on real growth signals.

Our investment strategies are regularly monitored and updated by the Investment Team, looking for deviation in long-term structural growth story. Our ML algorithm updates its recommendations quarterly, which is then researched by the investment team for inclusion / exclusion.

Kislay Upadhyay (Fund Manager and Founder) is a SEBI registered Investment Advisor (INA000016056)

Kislay

is the founder and CIO of

FidelFolio Investments.

Experienced in Fund Management industry, he has

worked

at Ambit Capital (Sr Analyst), Abakkus Asset

Managers (BFSI Analyst), Synergy Consulting (M&A) & National Stock Exchange. At Ambit,

his team pioneered

rule-based investing in India and developing investment strategy & book: 'Coffee Can

Investing’ (2018). He also

co-authored: 'The Big Call - Bubble in Quality' (2019).

Kislay holds MBA from IIM Lucknow, BE from VTU, CFA (Level II), NISM RA, RIA (XA, XB) and certificate holder of ‘AI in Financial Markets' by NSE Academy.

Gaurav is

business and product advisor (external) at FidelFolio Investments.

Gaurav has over a

decade of

experience in product management, technology & data science. He has worked across

various

roles in Microsoft, Tata Consultancy Services & First Data Corporation, and has been

awarded 'Rockstar' /'Beacon' in driving customer empathy and innovation. As Senior

Product Manager

in Microsoft, he is

involved in product strategy in UI using AI/ML & data

science.

He also co-founded Taxingo, a ride hailing

service.

Gaurav holds MBA from IIM Lucknow and BTech from IET, Lucknow.

Apurva

is Tech & ML Solutions Architect (external) at FidelFolio Investments.

He has been

in industry

defining roles at various leading IT Solutions firms across various verticals for over 8

years.

He has been instrumental in developing World’s

First Blockchain based multinational insurance solution

working with global giants including Berkshire Hathaway.

He has worked in development domain with NGOs and Governments providing technical

support for sustainable development initiatives.

Apurva holds PGD with specialization in Blockchain from IIIT Bangalore and BE from VTU.

Certain investments are not suitable for all investors. Before investing, consider your investment objectives and our fees. The rate of return on investments can vary widely over time, especially for short-term investments. Investment losses are possible, though less likely if held for medium to long-term. Please consider your risk profile before making investments.

Neither FidelFolio nor any of their respective affiliates or representatives make any explicit or implied representation or warranty as to the adequacy or accuracy of the statistical data or factual statement concerning India or its economy or make any representation as to the accuracy, completeness, reasonableness or sufficiency of any of the information contained in the presentation / newsletter / report herein, or in the case of projections, as to their attainability or the accuracy or completeness of the assumptions from which they are derived, and it is expected each prospective investor will pursue its own independent due diligence.